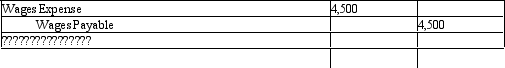

The following adjusting journal entry found in the journal is missing an explanation. Select the best explanation for the entry.

Definitions:

Adjusting Entry

An accounting entry made in the books at the end of an accounting period to allocate revenues and expenditures to the period in which they actually occurred.

Accrued Expenses

Expenses that have been incurred but not yet paid or recorded in the financial statements, representing future obligations.

Accrued Revenue

Revenue that has been earned but not yet received in cash or recorded by the accounting system.

Reversing Entries

Reversing entries are journal entries made at the beginning of an accounting period to negate the effects of certain adjustments made in the previous period.

Q50: Generally accepted accounting principles require accrual-basis accounting.

Q71: The difference between a classified balance sheet

Q85: The bookkeeper for Brockton Industries prepared the

Q120: In which of the following types of

Q125: An "Accounts Receivable Subsidiary Ledger" report shows<br>A)

Q139: Morgan Company has the following segment

Q143: For a month's transactions for a typical

Q149: The adjusted trial balance verifies that total

Q157: The Balance Sheet should be prepared<br>A) before

Q163: An adjusting entry to accrue an incurred