Use the following to answer questions :

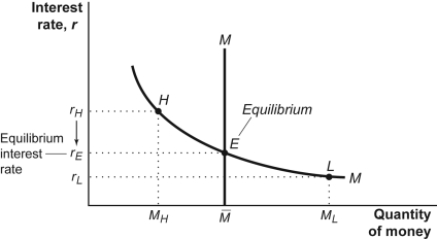

Figure: Money Market I

-(Figure: Money Market I) Look at the figure Money Market I. If the money market is initially in equilibrium at point E and the central bank sells Treasury bills, then the interest rate will:

Definitions:

Debt Financing

The method of raising capital through the sale of bonds, bills, or notes to individuals or institutional investors which must be repaid at a later date.

Equity Financing

The process of raising capital through the sale of shares in a company.

Term

The time until a debt security’s principal is due to be repaid. Also called the debt’s maturity or time until maturity.

Indirect Transfers

Transactions where assets or money move between entities or locations via intermediaries rather than through a direct exchange.

Q60: Reduction of inflation that is embedded in

Q62: If the money held by the public

Q88: In the long-run changes in the money

Q96: (Figure: Money Market I) Look at the

Q141: Following the panic of 1893 in the

Q142: Financial problems began in Greece in late

Q163: Suppose the Federal Reserve sells Treasury bills.

Q178: As people get used to inflation:<br>A) the

Q188: In 2010, Congress passed the Dodd-Frank Act,

Q267: A decrease in the demand for money