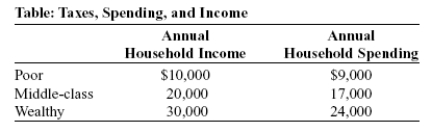

Use the following to answer questions:

-(Table: Taxes, Spending, and Income) Suppose Governor Meridias decides to initiate a state income tax. The first $50,000 of household income is tax-free, while any income above $50,000 is taxed at 10%. The tax rate for a household earning $75,000 is:

Definitions:

Equity Method

An accounting technique used to record investments in other companies, where the investment is initially recorded at cost and adjusted for the investor's share of the investee’s profits or losses.

Retained Earnings

The portion of a company's profit that is held or retained and not paid out as dividends to shareholders, often used for reinvestment in the business or to pay down debt.

Intra-Entity Transfer

Transactions involving assets, services, or funds between divisions or units within the same company, impacting financial statements when aggregated.

Equity Method

An accounting technique used by firms to assess the profits earned from their investments in other companies by recording such profits in proportion to their ownership stake in the invested company.

Q48: A price floor or a price ceiling

Q69: (Figure: The Markets for Melons in Russia)

Q153: Eli has annual earnings of $100,000 and

Q155: Typically the government limits the quantity of

Q171: Economists in general agree that rent controls

Q173: Income tax rates are such that Mr.

Q212: If a country removes a tariff on

Q228: (Table: Three Tax Structure Proposals) Look at

Q261: Comparative advantage arises from:<br>A) differences in climate,

Q267: (Table: Taxes, Spending, and Income) Suppose Governor