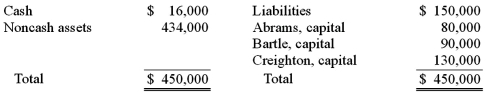

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:  Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000. If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000. If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

Definitions:

Q3: The terms of a will currently undergoing

Q7: LuAnn, a child development researcher, recently conducted

Q23: On January 1, 2011, Wakefield City purchased

Q28: Vincente intends to examine differences between three

Q29: Which of the following is important when

Q31: The following information pertains to inventory held

Q38: For the month of December 2011, patient

Q42: The town council adopted an annual budget

Q55: In accounting, the term translation refers to<br>A)

Q76: Under what circumstances does a partner's balance