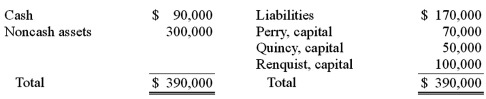

The following account balances were available for the Perry, Quincy, and Renquist partnership just before it entered liquidation:  Included in Perry's capital balance is a $20,000 partnership loan owed to Perry. Perry, Quincy, and Renquist shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be $15,000. All partners were solvent.

Included in Perry's capital balance is a $20,000 partnership loan owed to Perry. Perry, Quincy, and Renquist shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be $15,000. All partners were solvent.

What would be the minimum amount for which the noncash assets must have been sold, in order for Quincy to receive some cash from the liquidation?

Definitions:

Q6: Which of the following is a governmental

Q12: Hampton Company is trying to decide whether

Q16: Under the temporal method, depreciation expense would

Q39: As a researcher interested in young children's

Q41: In his study of effectiveness of driver's

Q43: The City of Nextville operates a motor

Q48: Jackie wants to examine teachers' efficacy for

Q58: What are the four interconnected goals that

Q61: What are accredited investors?

Q61: In not-for-profit accounting, an acquisition occurs when