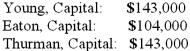

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Eaton's total share of net loss for the first year?

Definitions:

Pregnancy

The condition of having a developing embryo or fetus in the body, typically lasting about 40 weeks in humans from the last menstrual period to childbirth.

Abortion

The termination of pregnancy; spontaneous or induced.

Extrinsic Reward

A reward given by an external source, such as money or praise, which motivates certain behaviors or actions.

End-of-Year Bonus

A monetary incentive given to employees at the end of the calendar year, often based on company performance, profitability, or individual achievement.

Q16: A forward contract may be used for

Q18: A U.S. company buys merchandise from a

Q19: The Keaton, Lewis, and Meador partnership had

Q23: The following information pertains to inventory held

Q31: Mount Inc. was a hardware store that

Q31: A city operates a central data processing

Q32: Which two EU directives have helped harmonize

Q46: If a subsidiary is operating in a

Q72: Certain balance sheet accounts of a foreign

Q84: Esposito is an Italian subsidiary of a