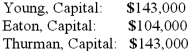

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Thurman's total share of net income for the second year?

Definitions:

Other-directedness

A personality orientation where an individual's behavior, thoughts, and beliefs are influenced heavily by external approval or social cues rather than personal values.

Problematic Emotions

Feelings or emotional states that cause distress or difficulty in functioning.

Socio-political Factors

Aspects that involve both social and political elements, influencing and shaping the behavior of individuals and societies.

Culturally Sensitive

An approach that is aware of and respects the differences between cultures, ensuring relevance and effectiveness.

Q9: What is the major assumption underlying the

Q28: Marie Todd works for the City of

Q34: A copy of the instrument used for

Q37: What financial statements would normally be prepared

Q41: Which accounts are translated using current exchange

Q55: On October 1, 2011, Eagle Company forecasts

Q62: The estate of Bobbi Jones has the

Q63: The executor of the Estate of Kate

Q64: What is the primary focus of the

Q82: Cleary, Wasser, and Nolan formed a partnership