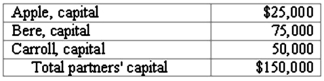

The partners of Apple, Bere, and Carroll LLP share net income and losses in a 5:3:2 ratio, respectively. The capital account balances on January 1, 2011, were as follows:  The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values. Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. The amount of cash that Dorr should invest in the partnership is:

The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values. Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. The amount of cash that Dorr should invest in the partnership is:

Definitions:

Allowance for Uncollectible Accounts

A reserve set aside in the accounting books for debts that are expected not to be collected, reflecting realistic income figures.

Troubled Debt

Debt that the borrower is unable to pay back according to the original agreement, leading to restructuring or modification of terms.

Debt Restructuring

The process of renegotiating the terms of existing loans to provide a distressed borrower with relief, which may include reducing the interest rate, extending payment terms, or reducing the total amount owed.

Collateral

Assets pledged by a borrower to secure a loan or other credit, and subject to seizure in the event of default.

Q1: Mount Inc. was a hardware store that

Q6: Assume the partnership of Dean, Hardin, and

Q16: Overgeneralization in a research report refers to<br>A)

Q18: Henry has a large body of qualitative

Q22: Making sense of what data mean is

Q54: A foreign subsidiary of a U.S. corporation

Q57: A U.S. company sells merchandise to a

Q61: A city enacted a special tax levy

Q75: On January 1, 2011, Lamb and Mona

Q93: The hardware operating segment of Bloom Corporation