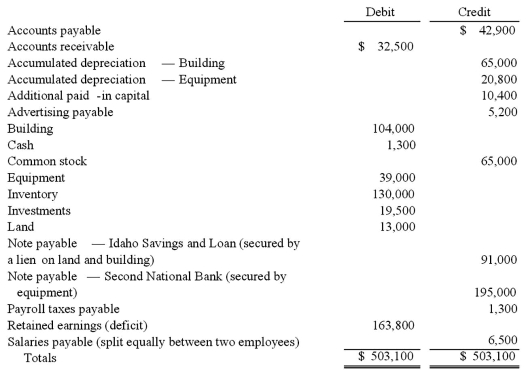

Mount Inc. was a hardware store that operated in Boise, Idaho. Management made some poor inventory acquisitions that loaded the store with unsalable merchandise. Due to the decline in revenues, the company became insolvent. Following is a trial balance as of March 15, 2011, the day the company filed for Chapter 7 liquidation.  Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation would have approximated $20,800.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation would have approximated $20,800.

Assume that the company was being liquidated and that the following transactions occurred:

• Accounts receivable of $23,400 were collected.

• All of the company's inventory was sold for $52,000.

• Additional accounts payable of $13,000 incurred for various expenses such as utilities and maintenance were discovered.

• The land and building were sold for $92,300.

• The note payable due to the Idaho Savings and Loan was paid.

• The equipment was sold at auction for only $14,300 with the proceeds applied to the note owed to the Second National Bank.

• The investments were sold for $27,300.

• Administrative expenses totaled $26,000 as of July 26, 2011, but no payment had yet been made.

Required:

Prepare a statement of realization and liquidation for the period from March 15 through July 26, 2011.

Definitions:

Plot Land

A marked piece of land designated for a specific use, such as construction, gardening, or other forms of development.

Mailbox Rule

A legal principle in contract law that states an offer is considered accepted at the moment the acceptance is mailed, rather than when the acceptance is received by the offeror.

Receipt Stipulation

An agreement or acknowledgment documenting the receipt of something, often used in legal contexts to prove the acceptance of documents or payments.

Mailbox Rule

A legal principle stating that an offer is considered accepted at the time the acceptance is sent through the mail, not when it is received by the offeror.

Q28: Jell and Dell were partners with capital

Q34: Which of the following is not normally

Q51: Which of the following is not a

Q53: A U.S. company buys merchandise from a

Q55: Kaycee Corporation's revenues for the year ended

Q59: Fiduciary funds are<br>A) Funds used to account

Q63: What is included in Part I of

Q70: The forward rate may be defined as<br>A)

Q95: Buckette Co. owned 60% of Shuvelle Corp.

Q105: Beagle Co. owned 80% of Maroon Corp.