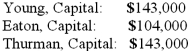

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Eaton's Capital account at the end of the first year?

Definitions:

Ownership

The state or fact of exclusive rights and control over property, which can be an object, land/real estate, intellectual property, or some form of rights to assets.

Benefits

Forms of value, other than payment, provided to employees in return for their contribution to the organization, such as healthcare, pensions, and leave entitlements.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period of time, ultimately presenting the net profit or loss.

Revenue Recognition

The accounting principle that deals with the specific conditions under which revenue is recognized and determines how to account for it.

Q3: The City of Wetteville has a fiscal

Q9: Lucky Co. had cash of $65,000, inventory

Q23: For May 2011, Carlington Hospital's charges for

Q26: The data analysis strategy that specifically consists

Q30: The City of Kamen maintains a collection

Q45: How does a voluntary health and welfare

Q47: During a reorganization, how should interest expense

Q76: A net liability balance sheet exposure exists

Q85: Cleary, Wasser, and Nolan formed a partnership

Q92: Quadros Inc., a Portuguese firm was acquired