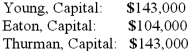

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Thurman's total share of net income for the second year?

Definitions:

Critical Value

A point on the scale of the test statistic beyond which we reject the null hypothesis; it depends on the chosen significance level.

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, usually set before the experiment.

Seat Belts

Devices aimed at protecting vehicle passengers from injurious motions that might occur in the event of an accident or abrupt halt.

Chi-Squared Test

A statistical test used to determine if there's a significant difference between the observed frequencies and the expected frequencies in one or more categories.

Q5: The executor of Danny Mack's estate has

Q16: How do the balance sheet and statement

Q21: Which group of financial statements is prepared

Q34: What were the major objectives of the

Q37: What are the two proprietary fund types?

Q47: For each of the following situations, select

Q54: A foreign subsidiary of a U.S. corporation

Q57: Lucky Co. had cash of $65,000, inventory

Q70: P, L, and O are partners with

Q75: The executor of Danny Mack's estate has