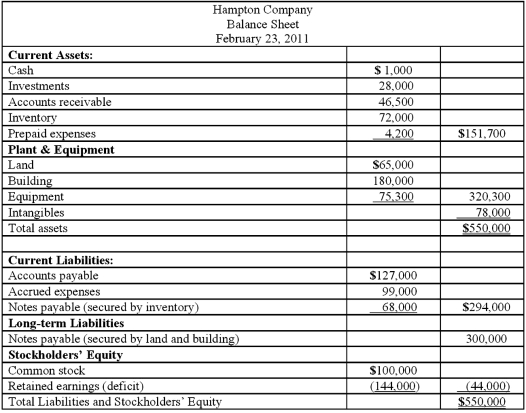

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:

Additional information is as follows:

● The investments are currently worth $13,000.

● It is estimated that $32,000 of the accounts receivable are collectible.

● The inventory can be sold for $74,000.

● The prepaid expenses and the intangible assets have no net realizable value.

● The land and building are currently valued at $250,000.

● The equipment can be sold for $60,000.

● Administrative expenses (not yet recorded) are estimated to be $12,500.

● Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

● Accrued expenses include $7,000 of unpaid payroll taxes.

Compute the amount of assets available for unsecured creditors after payment of liabilities with priority.

Definitions:

Deposition

The geological process by which sediments, soil, and rocks are added to a landform or landmass, often carried by wind, water, or ice.

Cutbank

A steep cut or slope formed by lateral erosion of a stream, especially on the outside bend of a channel.

Gradient

The rate of change of a quantity (e.g., temperature, pressure, or elevation) with respect to distance in a given direction.

Headwaters

The source of a river or stream, generally found in the high elevation areas from which the river originates.

Q1: Quadros Inc., a Portuguese firm was acquired

Q1: What is the appropriate account to credit

Q20: Gregor Inc. uses the LIFO cost-flow assumption

Q21: Elektronix, Inc. has three operating segments with

Q23: The following information pertains to inventory held

Q38: For the month of December 2011, patient

Q43: Property taxes of 1,500,000 are levied for

Q55: A company sells a building to a

Q64: What is the primary focus of the

Q75: Baker Corporation changed from the LIFO method