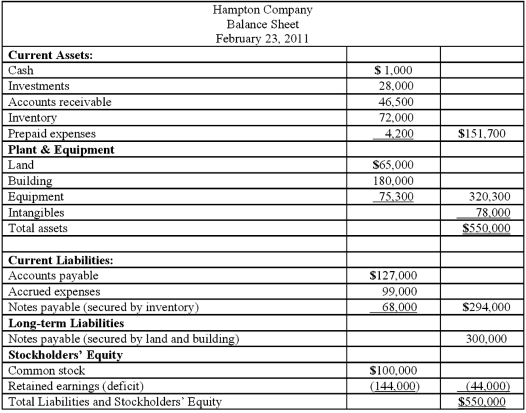

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:

Additional information is as follows:

● The investments are currently worth $13,000.

● It is estimated that $32,000 of the accounts receivable are collectible.

● The inventory can be sold for $74,000.

● The prepaid expenses and the intangible assets have no net realizable value.

● The land and building are currently valued at $250,000.

● The equipment can be sold for $60,000.

● Administrative expenses (not yet recorded) are estimated to be $12,500.

● Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

● Accrued expenses include $7,000 of unpaid payroll taxes.

How much will be paid to the holder of the note payable secured by the land and building?

(Round your payout percentage to the nearest whole number.)

Definitions:

Owners' Equity

The residual interest in the assets of an entity after deducting liabilities, representing the owners' claims on the business assets.

Liabilities

Liabilities represent a company's financial debts or obligations that arise during the course of business operations, to be repaid at a later date.

Tax Return Lines

Specific lines on a tax return document where taxpayers report information or figures as required by tax regulations.

Detailed Reports

Comprehensive documents that provide an in-depth analysis or summary of data related to a specific topic or period.

Q2: A local partnership has assets of cash

Q8: Which one of the following financial statements

Q9: Where is the disposition of a remeasurement

Q14: On a statement of financial affairs, a

Q32: A local social worker, earning $12 per

Q34: What were the major objectives of the

Q36: What are the three authoritative pronouncements that

Q42: A U.S. company sells merchandise to a

Q45: Cleary, Wasser, and Nolan formed a partnership

Q50: A partnership began its first year of