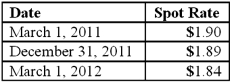

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

Definitions:

High-Density

Refers to a high level of mass per unit volume, often used in the context of populations, materials, or data storage.

Common Space

Areas accessible and used by the public or a community, including parks, shared gardens, and public squares.

Urban Areas

Regions characterized by higher population density and vast human features in comparison to areas surrounding them.

Employment

The condition of having paid work or the relationship between an employer and an employee.

Q4: Schilling, Inc. has three operating segments with

Q8: Which of the following would be an

Q20: On January 1, 2011, Pride, Inc. acquired

Q27: In translating a foreign subsidiary's financial statements,

Q30: How did the early International Accounting Standards

Q39: Under the temporal method, how would cost

Q40: Quadros Inc., a Portuguese firm was acquired

Q70: Explain how the treasury stock approach treats

Q73: The Fratilo Co. had three operating segments

Q82: Cleary, Wasser, and Nolan formed a partnership