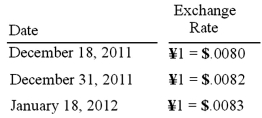

Gaw Produce Company purchased inventory from a Japanese company on December 18, 2011. Payment of 4,000,000 yen (¥) was due on January 18, 2012. Exchange rates between the dollar and the yen were as follows:  Required:

Required:

Prepare all journal entries for Gaw Produce Co. in connection with the purchase and payment.

Definitions:

Net Worth

Assets minus liabilities, which demonstrates the value of a business.

Business Value

The importance or worth of something to a business, including tangible and intangible benefits that contribute to the company's success.

Balance Sheet

Also known as a “statement of financial position”; reveals a company’s assets, liabilities and owner’s equity (net worth).

Financial Position

Refers to the status of an entity's assets, liabilities, and equity at a specific point in time, providing insight into its economic situation.

Q9: Stiller Company, an 80% owned subsidiary of

Q20: When the hybrid method is used to

Q20: Which statement is false regarding the registration

Q48: When preparing a consolidating statement of cash

Q55: Kaycee Corporation's revenues for the year ended

Q76: What documents or other sources of information

Q90: Belsen purchased inventory on December 1, 2010.

Q97: On February 23, 2011, Cleveland, Inc. paid

Q103: Pepe, Incorporated acquired 60% of Devin Company

Q104: Buckette Co. owned 60% of Shuvelle Corp.