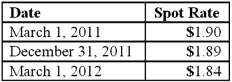

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Demolition

The process of deliberately destroying or dismantling buildings or structures, often to make way for new construction.

Explosives

Substances that undergo rapid chemical reactions, producing an immediate release of heat, gas, and pressure, often used in construction, demolition, or weaponry.

Architectural Blueprints

Detailed technical drawings and plans for constructing buildings, showing dimensions, layouts, and materials.

Dynamite

Dynamite is an explosive material invented by Alfred Nobel, consisting of nitroglycerin absorbed in a filler material, used for blasting and demolition.

Q1: Which of the following is not a

Q4: Principal Company is a U.S.-based company that

Q9: Stiller Company, an 80% owned subsidiary of

Q33: Larson Company, a U.S. company, has an

Q56: Quadros Inc., a Portuguese firm was acquired

Q76: What ownership pattern is referred to as

Q79: A net asset balance sheet exposure exists

Q112: Faru Co. identified five industry segments: (1)

Q117: Strong Company has had poor operating results

Q126: During 2011, Edwards Co. sold inventory to