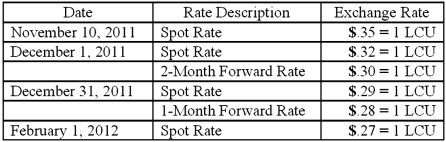

On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

(A.) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2011 net income.

(C.) Compute the effect on 2012 net income.

Definitions:

Facilitation Model

A concept in ecology suggesting that the presence of one species positively affects the growth, establishment, or reproduction of another species, often leading to a more complex community structure.

Soil Enriched

Soil that has been enhanced in nutrients and organic matter, improving fertility and the ability to support plant growth.

Growth Rate

The rate at which an organism grows, often measured in terms of size, height, or mass increase over time.

Births

The occurrence of a baby or babies being born.

Q1: Vapor Corporation has a fan products operating

Q13: Which of the following are not key

Q22: On October 1, 2011, Eagle Company forecasts

Q27: Which of the following statements is true

Q31: Norr and Caylor established a partnership on

Q71: Delta Corporation owns 90 percent of Sigma

Q83: Bazley Co. had severe financial difficulties and

Q91: A U.S. company's foreign subsidiary had the

Q106: The following information has been taken from

Q111: Where do dividends paid by a subsidiary