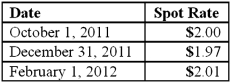

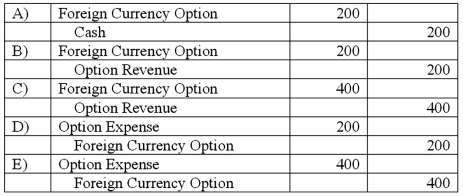

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on December 31, 2011?

What journal entry should Eagle prepare on December 31, 2011?

Definitions:

Weak Economy

An economic state characterized by slow growth, high unemployment, and underperforming industries, often leading to reduced consumer spending and lower standards of living.

Social Role Requirements

Social role requirements refer to the expectations and obligations associated with a particular social position, determining how individuals should behave in their social roles.

Tricky Questions

Questions designed to be difficult to answer, often used to test critical thinking or understanding.

Hard Enough

A phrase typically used to describe a situation or task that requires a significant degree of effort or determination to overcome.

Q21: A foreign subsidiary uses the first-in first-out

Q37: What is the purpose of a predistribution

Q38: The following information pertains to inventory held

Q41: Describe the two parts of the SEC

Q51: Harrison Company, Inc. began operations on January

Q59: A company acquired a new piece of

Q71: Which one of the following characteristics of

Q74: How should seasonal revenues be reported in

Q74: Old Colonial Corp. (a U.S. company) made

Q97: When preparing a consolidation worksheet for a