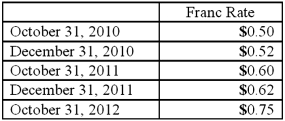

On October 31, 2010, Darling Company negotiated a two-year 100,000 franc loan from a foreign bank at an interest rate of 3 percent per year. Interest payments are made annually on October 31, and the principal will be repaid on October 31, 2012. Darling prepares U.S.-dollar financial statements and has a December 31 year-end. Prepare all journal entries related to this foreign currency borrowing assuming the following:

Definitions:

Revaluing Assets

The process of adjusting the book value of an asset to reflect its current market value rather than its original purchase price.

Major Disadvantage

A significant or principal drawback that adversely affects the effectiveness, efficiency, or desirability of an object, system, or method.

Ethical Lapses

Failures to act in an ethical manner, often resulting in behavior that is morally or professionally wrong.

Criminal Prosecution

The legal process in which an individual is charged with a crime by the government and faces trial and judgment.

Q2: The following information pertains to inventory held

Q14: EDGAR stands for:<br>A) Electronic Debits, Gains, Assets

Q24: A partnership began its first year of

Q55: Which of the following is not one

Q55: On October 1, 2011, Eagle Company forecasts

Q63: Candice Company is currently going through bankruptcy

Q70: Cadion Co. owned a controlling interest in

Q98: Prince Corp. owned 80% of Kile Corp.'s

Q102: Kurton Inc. owned 90% of Luvyn Corp.'s

Q109: How should revenues be recognized in interim