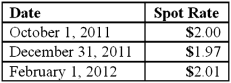

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2012 from these transactions?

What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2012 from these transactions?

Definitions:

Anorexia Nervosa

A serious psychological and eating disorder characterized by an extreme fear of weight gain and a distorted body image, leading to restricted food intake and excessive weight loss.

Teenage Girls

Female individuals who are in the age range of 13 to 19 years old, going through various physical, emotional, and social changes.

Teenage Boys

A demographic group defined by males typically aged between 13 to 19 years, undergoing physical, emotional, and psychological development.

Fallon And Rozin

Researchers known for their work in psychology, particularly in areas related to food and naturalistic fallacies in perceptions of healthiness.

Q6: Wolff Corporation owns 70 percent of the

Q7: Which of the following is not one

Q9: All of the following are examples of

Q15: The IASB and FASB are working on

Q33: Stark Company, a 90% owned subsidiary of

Q44: Quadros Inc., a Portuguese firm was acquired

Q63: On October 1, 2011, Eagle Company forecasts

Q71: Winston Corp., a U.S. company, had the

Q104: Buckette Co. owned 60% of Shuvelle Corp.

Q105: The following information has been taken from