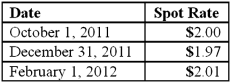

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of option expense for 2012 from these transactions?

What is the amount of option expense for 2012 from these transactions?

Definitions:

Iterative

Iterative refers to a process that repeats steps to achieve a desired outcome, often used in software development to progressively refine and improve the product.

Scripting Language

A programming language that supports scripts, enabling the automation of tasks that could alternatively be executed one-by-one by a human operator.

Corporate Environment

A professional setting often within a company where business activities, employee relations, and organizational structure are established and maintained.

PowerShell

A task-based command-line shell and scripting language designed especially for system administration.

Q17: What related items need to be disclosed

Q18: River Co. owned 80% of Boat Inc.

Q19: A partnership began its first year of

Q33: On its balance sheet, a company undergoing

Q41: Describe the two parts of the SEC

Q47: For each of the following situations, select

Q61: The balance sheets of Butler, Inc. and

Q66: Regulation S-K:<br>A) controls the listing of securities

Q83: What term is used to describe a

Q97: Pepe, Incorporated acquired 60% of Devin Company