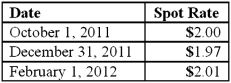

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the 2012 effect on net income as a result of these transactions?

What is the 2012 effect on net income as a result of these transactions?

Definitions:

Hippocampus

A major component of the brain involved in forming new memories and is associated with learning and emotions.

Endorphins

Natural, pain-relieving chemicals produced by the body that also contribute to feelings of pleasure and well-being.

Agonist

An agonist is a chemical or drug that binds to receptors in the brain and causes a reaction, often mimicking the action of naturally occurring substances.

Antagonist

Antagonist is a term used in various contexts to denote a force or character that opposes someone or something else, or in pharmacology, a substance that inhibits or blocks physiological actions.

Q6: The partners of Donald, Chief & Berry

Q11: A company acquired a new piece of

Q13: What are some of the reasons for

Q19: How does a company measure income tax

Q24: Which one of the following regulates the

Q26: In a statement of financial affairs, assets

Q67: Which one of the following forms is

Q68: As of January 1, 2011, the partnership

Q82: Mount Inc. was a hardware store that

Q86: Cleary, Wasser, and Nolan formed a partnership