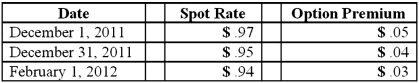

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:  Compute the fair value of the foreign currency option at December 31, 2011.

Compute the fair value of the foreign currency option at December 31, 2011.

Definitions:

Behaviour Modification

The application of behavioral change techniques to alter individuals' activities and reactions.

Esteem Needs

According to Maslow's hierarchy of needs, these are the fourth level and include self-esteem, confidence, respect by others, and respect for others.

Theory X

A management theory assuming that employees are inherently lazy and will avoid work if they can.

Behaviour Motivation

The drive behind individuals' actions, influenced by internal desires and external rewards.

Q3: What Federal agency has Congressional responsibility to

Q21: Which of the following is not a

Q22: Panton, Inc. acquired 18,000 shares of Glotfelty

Q32: What is the minimum net worth of

Q36: Which of the following are issued by

Q41: On October 1, 2011, Eagle Company forecasts

Q53: What are the six key FASB initiatives

Q85: Parent Corporation acquired some of its subsidiary's

Q91: On March 1, 2011, Mattie Company received

Q109: Anderson, Inc. has owned 70% of its