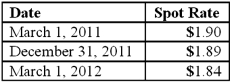

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

Definitions:

Information Transfer

The process by which information is conveyed from one person, group, or place to another through varying media or systems.

Long-Term Memory

The phase of memory that is responsible for storing information over extended periods, potentially for a lifetime.

Episodic Memory

A subtype of long-term memory that involves the recollection of specific events, situations, and experiences from one's own life.

Procedural Memory

A type of long-term memory responsible for knowing how to perform tasks, such as riding a bike or typing, without conscious awareness of the learned movements.

Q10: As of January 1, 2011, the partnership

Q12: Strayten Corp. is a wholly owned subsidiary

Q13: Delta Corporation owns 90 percent of Sigma

Q19: Which one of the following is not

Q25: Elektronix, Inc. has three operating segments with

Q35: Anderson, Inc. has owned 70% of its

Q47: Gargiulo Company, a 90% owned subsidiary of

Q49: Which of the following statements is false

Q68: Jull Corp. owned 80% of Solaver Co.

Q115: Gargiulo Company, a 90% owned subsidiary of