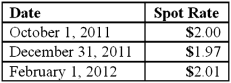

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2012 from these transactions?

What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2012 from these transactions?

Definitions:

Supervising

The act of overseeing and directing the performance of tasks or activities, typically carried out by a person in a position of authority.

Conservation

In the context of developmental psychology, it refers to a child's ability to recognize that quantity remains the same despite changes in its shape or form.

Cross-Cultural Psychologist

A psychologist who studies the cultural factors that influence human behavior, beliefs, and emotions.

Piaget's Preoperational Level

A stage in Jean Piaget's theory of cognitive development, in which children from about 2 to 7 years of age demonstrate symbolic thinking but are not yet able to perform operations of logic.

Q1: Which of the following statements is true

Q13: What are the four categories of debts

Q21: On December 1, 2011, Keenan Company, a

Q28: Who must accept and confirm the Reorganization

Q32: How do intra-entity sales of inventory affect

Q70: P, L, and O are partners with

Q72: According to U.S. GAAP, what revenues and

Q84: Woolsey Corporation, a U.S. company, expects to

Q100: How are intra-entity inventory transfers treated on

Q105: When defining a reportable segment, which of