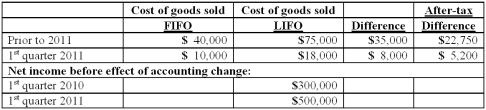

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

Definitions:

Capital Gains

The income gained when the selling price of assets such as stocks, bonds, or real estate surpasses their original buying price.

Economic Growth

An increase in the production of goods and services in an economy over a period of time.

Short-Term Capital Gain

Profit from the sale of an asset held for less than a year, subject to tax at ordinary income tax rates.

Net Working Capital

Represents a measure of a firm's liquidity by calculating the excess of current assets over current liabilities, portraying the company's operational efficiency.

Q28: How should contingencies be reported in an

Q38: Keefe, Inc., a calendar-year corporation, acquires 70%

Q43: Quadros Inc., a Portuguese firm was acquired

Q54: What is the appropriate treatment in an

Q56: What is the appropriate treatment in an

Q56: Which one of the following forms is

Q68: Coyote Corp. (a U.S. company in Texas)

Q78: Hampton Company is trying to decide whether

Q86: Parent Corporation acquired some of its subsidiary's

Q103: According to U.S. GAAP, how should common