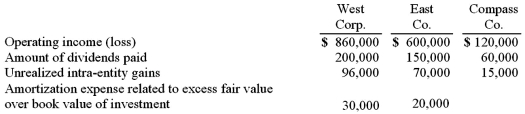

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. For West Corp. and consolidated subsidiaries, what total amount would have been reported for the non-controlling interest's share of subsidiaries' net income?

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. For West Corp. and consolidated subsidiaries, what total amount would have been reported for the non-controlling interest's share of subsidiaries' net income?

Definitions:

Trust

The firm belief in the reliability, truth, ability, or strength of someone or something.

Commitment

The state or quality of being dedicated to a cause, activity, or goal, showing willingness to give time and energy to something believed in.

Honesty

The quality of being truthful, transparent, and free from deceit in one’s actions and statements.

Obligation

A duty or commitment that compels someone to act in a certain way, often based on moral or legal reasons.

Q29: On March 1, 2011, Mattie Company received

Q36: Mills Inc. had a receivable from a

Q48: Pell Company acquires 80% of Demers Company

Q49: How has the Sarbanes-Oxley Act of 2002

Q50: The benefits of filing a consolidated tax

Q55: A company sells a building to a

Q56: What is the purpose of Chapter 7

Q58: Caldwell Inc. acquired 65% of Club Corp.

Q87: Delta Corporation owns 90 percent of Sigma

Q99: On January 1, 2010, Cale Corp. paid