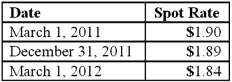

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Theory of Work Adjustment

A psychological theory that suggests job satisfaction and performance result from the correspondence between an individual's abilities and values and the demands and rewards of a job.

TWA

Stands for Theory of Work Adjustment, a framework that describes how individuals seek to achieve and maintain correspondence with their work environment.

Workplace Requirements

The set of conditions or tasks that are necessary for the operation of a job or workplace environment.

Individual Requirements

Refers to the unique needs or conditions necessary for a person to effectively perform or engage in a specific task or activity.

Q3: What Federal agency has Congressional responsibility to

Q15: Dean Hardware, Inc. is comprised of five

Q26: The capital account balances for Donald &

Q34: The ABCD Partnership has the following balance

Q41: The advantages of the partnership form of

Q45: Cleary, Wasser, and Nolan formed a partnership

Q60: Cleary, Wasser, and Nolan formed a partnership

Q65: A company that was to be liquidated

Q76: Which one of the following registration statement

Q95: Which of the following statements is true