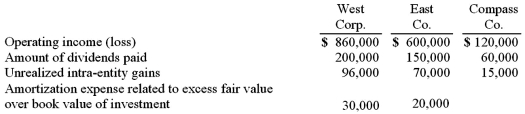

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. What amount should have been reported for consolidated net income?

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. What amount should have been reported for consolidated net income?

Definitions:

Advertisements

Messages designed to promote or sell a product, service, or idea to consumers or audiences.

Wilcoxon Signed Rank Test

A non-parametric statistical test used to compare two related samples, to assess whether their population mean ranks differ.

Nonparametric Method

Statistical methods that do not assume a specific distribution for the data, making them flexible in analyzing data without certain underlying assumptions.

Independent Samples

Two or more groups of data that do not influence each other and are randomly selected from a population.

Q2: A company that was to be liquidated

Q7: The following information pertains to inventory held

Q15: What was the purpose of the Securities

Q19: A company incurs research and development costs

Q29: On March 1, 2011, Mattie Company received

Q52: Skipen Corp. had the following stockholders' equity

Q70: The forward rate may be defined as<br>A)

Q70: On January 1, 2010, Cale Corp. paid

Q96: Under the current rate method, inventory at

Q96: Generally accepted accounting principles require a U.S.