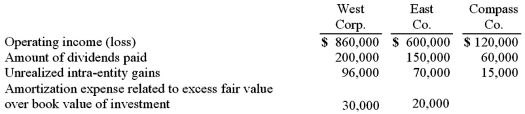

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. What amount of dividends did West Corp. receive from Compass Co.?

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. What amount of dividends did West Corp. receive from Compass Co.?

Definitions:

Underwriter's Buying Price

The price at which an underwriter agrees to buy securities from the issuer to subsequently sell them to the public, usually at a higher price.

Spread

The difference between the buying price and selling price of a financial instrument, or between the bid and ask prices.

Standby Underwriting Agreement

An arrangement where the underwriter agrees to buy any of the unsold shares in a public offering at a predetermined price.

Underwriter's Buying Price

The price at which an underwriter agrees to purchase securities from the issuer, which they will then sell to the public or investors.

Q7: Ryan Company owns 80% of Chase Company.

Q15: Dean Hardware, Inc. is comprised of five

Q16: Baker Corporation changed from the LIFO method

Q30: Strickland Company sells inventory to its parent,

Q42: When consolidating a subsidiary under the equity

Q47: Chase Company owns 80% of Lawrence Company

Q58: Under the temporal method, property, plant &

Q94: If newly issued debt is issued from

Q103: Pell Company acquires 80% of Demers Company

Q120: An intra-entity sale took place whereby the