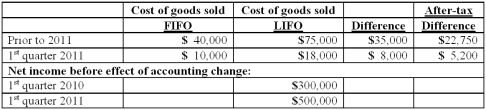

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011?

Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011?

Definitions:

Market Price

The present cost at which a product or service is available for purchase or sale in the market.

Economic Profit

The difference between a firm's total revenue and its opportunity costs, including both explicit and implicit costs.

State Licensing Fee

A mandatory charge paid to a state government for the issuance of a license to conduct a particular business or profession within that state's jurisdiction.

Marginal Cost

The escalation in aggregate cost stemming from the production of one more unit of a good or service.

Q16: Baker Corporation changed from the LIFO method

Q27: Royce Co. acquired 60% of Park Co.

Q35: Mandich Co. had the following amounts for

Q49: Which of the following statements is false

Q53: On January 1, 2011, Pride, Inc. acquired

Q57: Chain Co. owned all of the voting

Q71: Hampton Company is trying to decide whether

Q73: On January 1, 2011, a subsidiary bought

Q92: Quadros Inc., a Portuguese firm was acquired

Q102: Strickland Company sells inventory to its parent,