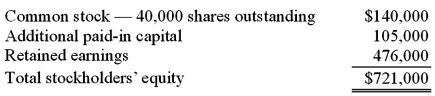

These questions are based on the following information and should be viewed as independent situations. Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Hallucinations

Perceptual experiences without the presence of an external stimulus, which are real to the person experiencing them, often seen in mental health conditions.

Dream-like Experiences

Mental experiences that occur in a state of consciousness resembling dreaming, whether in sleep or waking life.

Impaired Thinking

Refers to a decrease in the ability to think clearly, process information, make decisions, or understand concepts.

Ambivalence

The state of having mixed feelings or contradictory ideas about something or someone.

Q2: Pell Company acquires 80% of Demers Company

Q19: On March 1, 2011, Mattie Company received

Q35: Tara Company owns 80 percent of the

Q37: Dog Corporation acquires all of Cat, Inc.

Q43: McGuire Company acquired 90 percent of Hogan

Q59: For a foreign subsidiary that uses the

Q70: The forward rate may be defined as<br>A)

Q77: On 4/1/09, Sey Mold Corporation acquired 100%

Q98: Tray Co. reported current earnings of $560,000

Q108: Fargus Corporation owned 51% of the voting