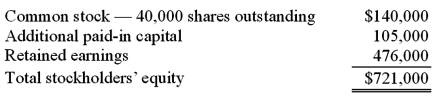

These questions are based on the following information and should be viewed as independent situations. Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $21 per share. Popper did not acquire any of this newly issued stock. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

National Average

The arithmetic mean or median of certain measurements or statistics considered across a whole nation.

One-sample T-test

A statistical test used to compare the mean value of a sample to a known value (usually the population mean) to see if there are significant differences.

Null Hypothesis

A statistical hypothesis that assumes no significant difference or effect exists within a set of given observations.

P-value

A measure in statistics that helps to determine the significance of results derived from a hypothesis test.

Q8: Coyote Corp. (a U.S. company in Texas)

Q11: Thomas Inc. had the following stockholders' equity

Q20: Which one of the following is not

Q24: The financial statements for Goodwin, Inc., and

Q47: For each of the following situations, select

Q50: Which of the following approaches is used

Q72: Bullen Inc. acquired 100% of the voting

Q73: Parker owned all of Odom Inc. Although

Q108: Natarajan, Inc. had the following operating segments,

Q122: When comparing the difference between an upstream