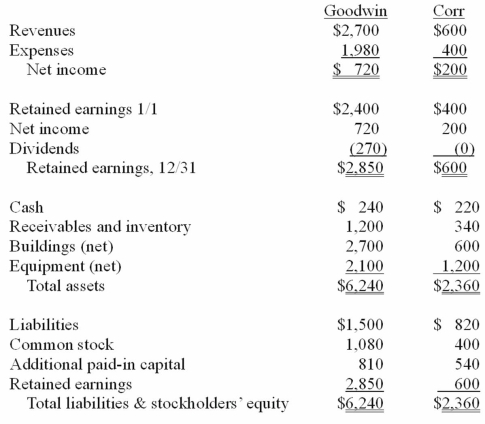

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated revenues for 20X1.

Definitions:

Harassment

Behavior that is intimidating, hostile, or offensive to another person, often in the workplace or social setting.

Demotion

The act of lowering an employee's rank or position, usually as a disciplinary measure or due to organizational restructuring.

Discharge

The termination of an employee's job position by the employer, often for cause such as misconduct or poor performance.

Aggregate Welfare

The total level of well-being or economic prosperity of a community, region, or country, considering all individuals and factors collectively.

Q1: The respiratory system<br>A)Shapes air stream into speech

Q6: AAC symbol sets do not have specified

Q7: Articulation and phonological disorders may be caused

Q11: Factors that should be considered in determining

Q11: Justin was born in Chicago with a

Q15: Nasal air emission and hypernasality produce identical

Q57: Which one of the following is a

Q73: Royce Co. acquired 60% of Park Co.

Q101: Pell Company acquires 80% of Demers Company

Q110: Velway Corp. acquired Joker Inc. on January