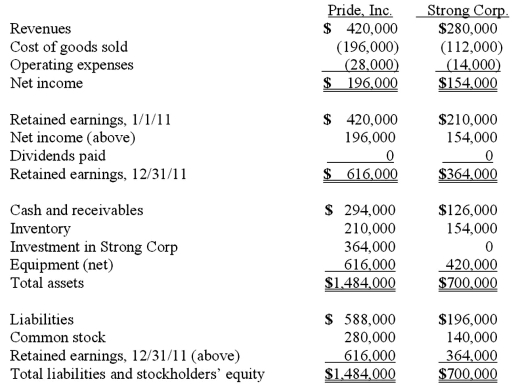

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the consolidated total for equipment (net) at December 31, 2011?

Definitions:

GAAP

Generally Accepted Accounting Principles, which are a collection of commonly followed accounting rules and standards for financial reporting.

Quarterly Income

The net income earned by a company during a three-month period, typically reported in quarterly financial statements.

Operating Segments

Components of an enterprise that engage in business activities from which it may earn revenues and incur expenses, whose operating results are regularly reviewed by the entity's chief operating decision maker.

Financial Reporting

The process of disclosing financial results and related information to stakeholders and the public, typically through formal documents.

Q1: On January 1, 20X1, the Moody Company

Q20: Gregor Inc. uses the LIFO cost-flow assumption

Q23: Which items of information are required to

Q28: What factors create a foreign exchange gain?

Q38: Atlarge Inc. owns 30% of the outstanding

Q40: Quadros Inc., a Portuguese firm was acquired

Q71: Stiller Company, an 80% owned subsidiary of

Q80: Which of the following statements is true

Q86: Yaro Company owns 30% of the common

Q92: What is the major objective of segment