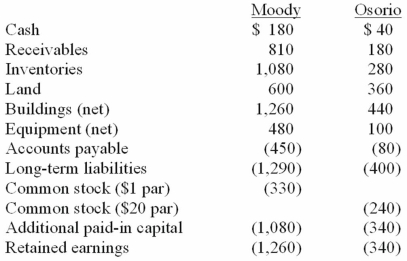

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

SEC

The Securities and Exchange Commission, a U.S. government agency responsible for regulating the securities markets and protecting investors.

Short Positions

An investment strategy where an investor sells a security they do not own, betting that its price will decrease.

Futures Contract

An agreement to buy or sell a specified quantity of a commodity or financial asset at a predetermined price at a specified future date.

Delivery Date

The specific date on which a financial transaction, typically involving commodities or currencies, is set to be completed.

Q1: Changes within genes can produce proteins that

Q2: Benjamin was not making progress with achieving

Q12: The focus of evidence-based practice is to

Q16: Hakim is a 12 year old African

Q17: Phonological processes<br>A)Are rules for combining individual speech

Q28: What accounting method requires a subsidiary to

Q43: A parent company owns a controlling interest

Q58: Caldwell Inc. acquired 65% of Club Corp.

Q63: Under the initial value method, when accounting

Q82: Perry Company acquires 100% of the stock