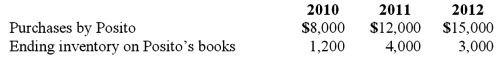

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to cost of goods sold for the 2011 consolidation worksheet with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2011 consolidation worksheet with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

Definitions:

Financial Statements

Financial statements are formal records of the financial activities and position of a business, person, or other entity, providing a detailed insight into its financial performance over a certain period.

Deferred Asset

An expenditure that has been made and recorded but will not be recognized as an expense until future accounting periods.

Damages Award

Compensation determined by a court or agreement for losses or harm suffered by a party due to another's actions or failures.

Provisions Disclosure

The requirement in financial reporting to disclose information about any significant provisions for future liabilities or charges.

Q6: On October 1, 2011, Eagle Company forecasts

Q19: On January 1, 20X1, the Moody Company

Q31: Which of the following statements is false

Q38: Perry Company acquires 100% of the stock

Q45: A spot rate may be defined as<br>A)

Q58: On December 1, 2011, Keenan Company, a

Q75: Wilson owned equipment with an estimated life

Q80: Gargiulo Company, a 90% owned subsidiary of

Q93: Perry Company acquires 100% of the stock

Q121: Racer Corp. acquired all of the common