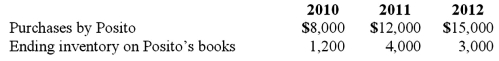

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to cost of goods sold for the 2012 consolidation worksheet with regard to the unrealized gross profit of the 2012 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2012 consolidation worksheet with regard to the unrealized gross profit of the 2012 intra-entity transfer of merchandise?

Definitions:

Capillary Refill

A test to assess blood circulation, where pressure is applied to a fingernail or toenail and the time is measured for color to return, indicating the efficiency of blood flow.

Bradycardia

A medical condition characterized by an abnormally slow heart rate, typically fewer than 60 beats per minute in adults.

Acute Diarrhea

A sudden onset of frequent, watery bowel movements that can lead to dehydration, often caused by infection, food intolerance, or medications.

Celiac Disease

An autoimmune disorder where ingestion of gluten leads to damage in the small intestine, causing digestive issues and nutrient malabsorption.

Q5: Goodwill is often acquired as part of

Q26: On January 1, 20X1, the Moody Company

Q51: Which of the following statements is true

Q63: Which of the following is a criterion

Q71: Stiller Company, an 80% owned subsidiary of

Q80: On January 1, 2010, Jones Company bought

Q87: Under the equity method, when the company's

Q100: Pell Company acquires 80% of Demers Company

Q102: Strickland Company sells inventory to its parent,

Q110: The financial statements for Goodwin, Inc., and