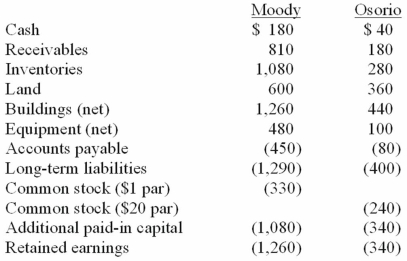

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated land at date of acquisition.

Definitions:

Coworker

A coworker is a person with whom one works, typically someone in the same job or workplace.

Monitor

A device or program that observes, keeps track of, or displays information, often used in computers or medical equipment.

Hardware

The physical components and devices that make up a computer or computer system.

Software

Programs and operating information used by a computer to perform specific tasks or functions.

Q6: Normal swallowing takes place on the inspiration

Q7: Several years ago Polar Inc. acquired an

Q11: Pot Co. holds 90% of the common

Q14: Jaynes Inc. acquired all of Aaron Co.'s

Q19: Categories of voice disorders include<br>A)Functional voice disorders<br>B)Organic

Q25: On January 2, 2011, Heinreich Co. paid

Q56: Which of the following internal record-keeping methods

Q85: Parent Corporation acquired some of its subsidiary's

Q104: McGuire Company acquired 90 percent of Hogan

Q114: Wilson owned equipment with an estimated life