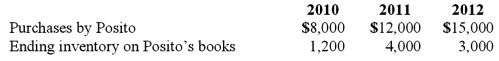

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2010 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2010 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

Definitions:

Standard Costs

Predetermined costs for materials, labor, and overhead used as benchmarks in budgeting and performance evaluation.

Anticipated Costs

Estimated costs expected to be incurred in the future for a project, activity, or operation.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity, making it more useful for controlling costs than a static budget.

Worst-Case Scenario

The most adverse or unfavorable outcome that may happen in a given situation.

Q4: Bale Co. acquired Silo Inc. on December

Q21: Elektronix, Inc. has three operating segments with

Q51: Which of the following statements is true

Q54: What is the basic objective of all

Q58: Faru Co. identified five industry segments: (1)

Q61: Wilson owned equipment with an estimated life

Q67: Beatty, Inc. acquires 100% of the voting

Q77: An example of a difference in types

Q82: Beagle Co. owned 80% of Maroon Corp.

Q90: Belsen purchased inventory on December 1, 2010.