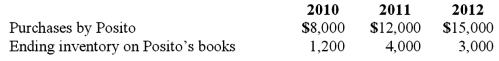

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2011 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2011 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

Definitions:

Mean Ages

The average age of individuals in a population or sample, calculated by summing their ages and dividing by the number of individuals.

Full-time Students

Individuals enrolled in an educational institution who take the majority of coursework offered or meet a minimum number of credit hours, as defined by the institution, to be considered as attending full-time.

Degrees of Freedom

The sum of distinct quantities or values applicable to a statistical distribution.

ACT Scores

A standardized test score used in the United States for college admissions, measuring proficiency in areas like English, mathematics, reading, and science.

Q7: Ryan Company owns 80% of Chase Company.

Q9: What is the major assumption underlying the

Q12: The financial balances for the Atwood Company

Q27: Royce Co. acquired 60% of Park Co.

Q30: How would consolidated earnings per share be

Q86: Pell Company acquires 80% of Demers Company

Q98: The financial statements for Jode Inc. and

Q98: Which one of the following items must

Q106: The following information has been taken from

Q120: An intra-entity sale took place whereby the