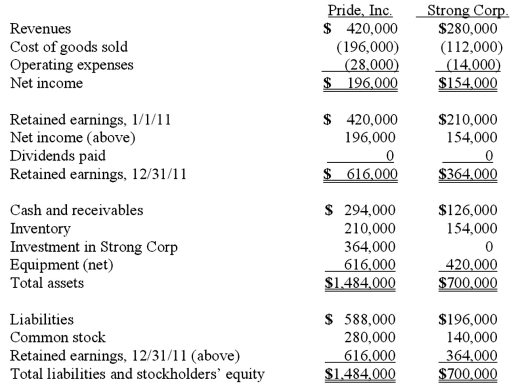

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the total of consolidated operating expenses?

Definitions:

Personality Style

An individual's characteristic patterns of thought, emotion, and behavior, together forming their unique personality.

Behavioral Changes

Modifications or adjustments in individual actions or reactions to better adapt to environmental or internal stimuli.

Social Support

The assistance and comfort provided by friends, family, and others, which can be emotional, informational, or tangible, contributing significantly to an individual's coping and well-being.

Immune Functioning

The performance and health of the immune system in protecting the body against diseases and pathogens.

Q2: Presented below are the financial balances for

Q6: Pell Company acquires 80% of Demers Company

Q9: White Company owns 60% of Cody Company.

Q41: Gargiulo Company, a 90% owned subsidiary of

Q44: River Co. owned 80% of Boat Inc.

Q46: Chase Company owns 80% of Lawrence Company

Q48: On January 1, 2010, Jumper Co. acquired

Q89: McLaughlin, Inc. acquires 70 percent of Ellis

Q107: When is the gain on an intra-entity

Q113: Which of the segments are separately reportable?<br>A)