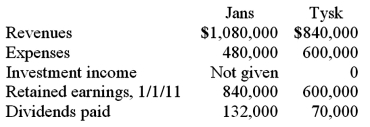

Jans Inc. acquired all of the outstanding common stock of Tysk Corp. on January 1, 2009, for $372,000. Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000. Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years. Tysk earned reported net income of $180,000 in 2009 and $216,000 in 2010. Dividends of $70,000 were paid in each of these two years. Selected account balances as of December 31, 2011, for the two companies follow.  If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2011?

If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2011?

Definitions:

Tractor-Semi Trailer

A truck configuration where a towing engine (tractor) is connected to one or more trailers.

Overall Length

The total length of a vehicle or component from its furthest point at the front to its furthest point at the back.

Internal Rate Of Return

The required rate of return that achieves a net present value of zero across all cash flows from a given project.

Required Rate Of Return

The minimum annual percentage earnings needed from an investment to make it worthwhile for the investor, considering the risk involved.

Q2: How does the use of the equity

Q2: On January 1, 2011, Musial Corp. sold

Q10: The anatomy and physiology of the vocal

Q59: On January 1, 2010, Smeder Company, an

Q78: Alpha Corporation owns 100 percent of Beta

Q83: Carnes has the following account balances as

Q90: Horse Corporation acquires all of Pony, Inc.

Q105: The following information has been taken from

Q109: Anderson, Inc. has owned 70% of its

Q111: Parsons Company acquired 90% of Roxy Company