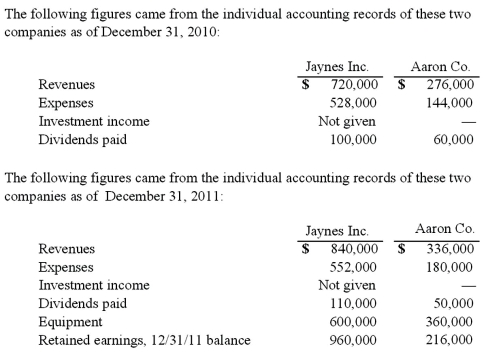

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What was consolidated equipment as of December 31, 2011?

What was consolidated equipment as of December 31, 2011?

Definitions:

Expected Price Level

The anticipated average cost of goods and services in the future, based on current trends, policies, and economic conditions.

Actual Price Level

The current average level of prices for goods and services in an economy, reflecting inflation or deflation.

Corrective Actions

Steps taken to fix a problem or eliminate a cause of nonconformities in processes or products.

Expected Price Level

The anticipation or forecast of future prices overall, impacting saving and spending decisions of consumers and businesses.

Q1: The most frequently occurring communication disorders are

Q13: A language milestone characteristic of the toddler

Q19: Specific genes have been associated with deafness

Q20: What is the primary difference between recording

Q25: Thomas Inc. had the following stockholders' equity

Q40: Campbell Inc. owned all of Gordon Corp.

Q66: Perch Co. acquired 80% of the common

Q108: On January 1, 2011, Chester Inc. acquired

Q111: On January 1, 2011, Bangle Company purchased

Q118: Perry Company acquires 100% of the stock