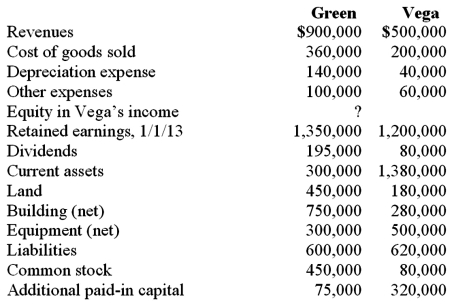

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated total expenses.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated total expenses.

Definitions:

Consolidated Statement

A financial report that combines the financial results of a parent company and its subsidiaries, presenting the financials as a single entity.

Consolidated Net Income

The total net income of a parent company and its subsidiaries after adjusting for inter-company transactions and minority interests, presented in consolidated financial statements.

Dividends

Money given by a business to its owners, often sourced from the firm's profits.

Financing Activities

Cash flow activities related to raising capital and repaying shareholders, including issuing debt, selling equity, dividends, and repaying debt.

Q2: On January 1, 2011, Musial Corp. sold

Q2: Researchers are conducting studies to determine genetic

Q14: The following are preliminary financial statements for

Q17: When should an investor not use the

Q55: Pell Company acquires 80% of Demers Company

Q62: Which of the following statements is false

Q69: On January 1, 2011, Riley Corp. acquired

Q74: Fargus Corporation owned 51% of the voting

Q92: Jans Inc. acquired all of the outstanding

Q100: Jager Inc. holds 30% of the outstanding