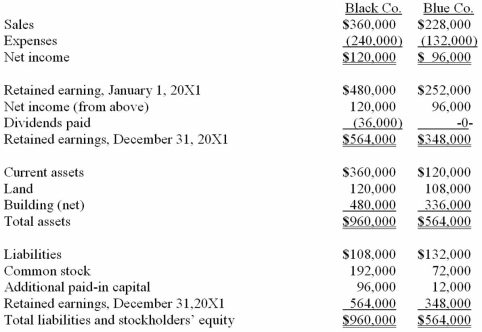

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 20X1.  On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 20X1 assuming the transaction is treated as a purchase combination.

Definitions:

Cognitive Dissonance

A psychological phenomenon that occurs when an individual experiences mental discomfort due to holding contradictory beliefs, ideas, or values at the same time.

Social Loafing

A phenomenon where individuals exert less effort to achieve a goal when they work in a group compared to when they work alone.

Groupthink

A psychological phenomenon that occurs within a group of people, where the desire for harmony or conformity results in an irrational or dysfunctional decision-making outcome.

Discrimination

Unequal and unfavorable treatment of people belonging to distinct groups, usually on the grounds of their race, age, sex, or disabilities.

Q4: Why do intra-entity transfers between the component

Q7: Incidence refers to the number of new

Q7: On January 1, 2010, Jannison Inc. acquired

Q17: Children with developmental language delay often produce

Q19: On January 1, 2010, Franel Co. acquired

Q52: Pepe, Incorporated acquired 60% of Devin Company

Q53: On January 1, 2011, Pride, Inc. acquired

Q56: Stark Company, a 90% owned subsidiary of

Q117: Yukon Co. acquired 75% percent of the

Q118: Perry Company acquires 100% of the stock