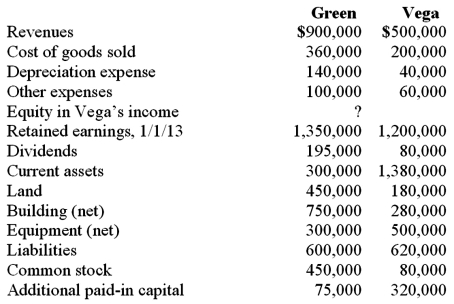

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013 consolidated retained earnings.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013 consolidated retained earnings.

Definitions:

Negotiable Instruments

Financial documents that guarantee the payment of a specific amount of money, either on-demand or at a set time, to the holder of the instrument.

Nonconforming Goods

Goods delivered under a contract that fail to meet the specifications or quality standards agreed upon.

Conforming Goods

Items that meet the specifications and requirements agreed upon in a contract or specified by law, particularly in sale transactions.

Future Goods

Goods that are not currently in existence but are expected to be produced or acquired by the seller in the future.

Q3: Speech is the process of producing complex

Q14: The following are preliminary financial statements for

Q19: Neurogenic speech disorders are caused by damage

Q25: Delta Corporation owns 90 percent of Sigma

Q27: On January 3, 2011, Austin Corp. purchased

Q28: What accounting method requires a subsidiary to

Q39: For an acquisition when the subsidiary retains

Q66: Following are selected accounts for Green Corporation

Q76: What documents or other sources of information

Q84: On January 1, 2011, Race Corp. acquired