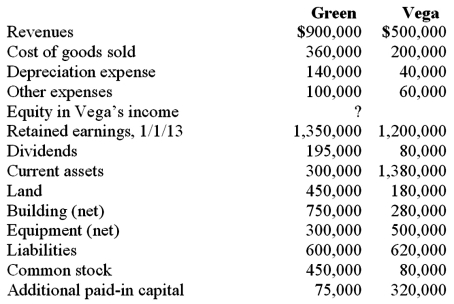

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated trademark.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated trademark.

Definitions:

Financial Advantage

The benefit gained in financial terms that gives an individual or business a superior position relative to competitors.

Traceable Fixed Costs

Fixed costs that can be directly associated with a specific business segment or area.

Net Operating Income

The profit generated from a company's everyday business operations, indicating the company's ability to generate income through sales after covering operating expenses.

Total Common Corporate Costs

Overhead or administrative expenses shared across the various divisions or departments of a company.

Q4: Bale Co. acquired Silo Inc. on December

Q4: On January 1, 2009, Dermot Company purchased

Q8: For an acquisition when the subsidiary retains

Q13: Fasciculations refer to voluntary twitches of individual

Q18: Myasthenia Gravis is a neurological disorder in

Q34: T Corp. owns several subsidiaries that are

Q76: Parent sold land to its subsidiary for

Q83: Vontkins Inc. owned all of Quasimota Co.

Q106: How are stock issuance costs and direct

Q109: What is the primary objective of the