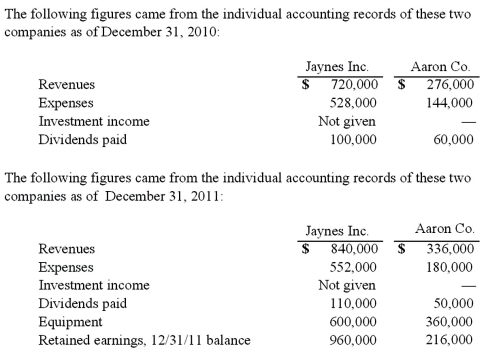

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What was consolidated net income for the year ended December 31, 2011?

What was consolidated net income for the year ended December 31, 2011?

Definitions:

Decisional Conflict

The uncertainty about which course of action to take when the options involve risk, loss, or challenge to personal life values.

NANDA-I Handbook

A comprehensive guide that provides standardized nursing diagnoses to assist in the assessment and care planning for patients.

Personal Values

Fundamental beliefs or standards that individuals hold to be important, guiding their behavior and decisions.

NANDA-I

An organization (North American Nursing Diagnosis Association International) that develops, updates, and promotes standardized nursing diagnostic terminology.

Q3: Both John and Amy exhibit articulation errors

Q7: The financial statements for Goodwin, Inc., and

Q15: Nasal air emission and hypernasality produce identical

Q17: The financial statements for Goodwin, Inc., and

Q26: When is a goodwill impairment loss recognized?<br>A)

Q72: Which of the following will result in

Q81: On January 1, 2010, Dawson, Incorporated, paid

Q101: Webb Co. acquired 100% of Rand Inc.

Q102: Bullen Inc. acquired 100% of the voting

Q102: Perch Co. acquired 80% of the common