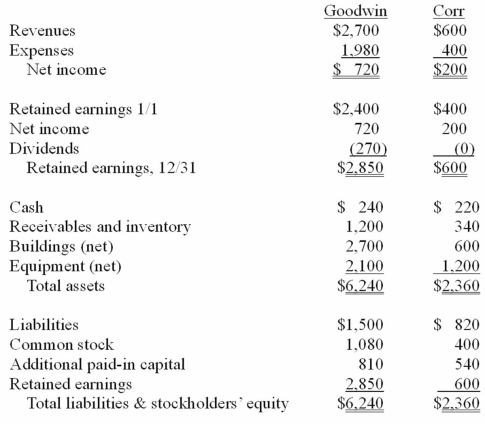

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated additional paid-in capital at December 31, 20X1.

Definitions:

Milk of Magnesia

An over-the-counter medication used as an antacid and laxative.

Magnesium Hydroxide

A chemical compound commonly used as an antacid to neutralize stomach acid or as a laxative for short-term relief of constipation.

Bid

An offer made by an individual or company to buy something or to perform a job for a certain price.

Narrative Charting

A method in medical documentation where healthcare professionals detail a patient's care, condition, and progress in a story-like format.

Q1: The ONL will<br>A)Allow you and the child

Q2: Babies born with isolated cleft palate are

Q3: Momentary increases in vocal pitch while repeating

Q5: Julie is a 2-year old with a

Q9: The speech-language pathologist decides to participate in

Q84: On January 1, 2010, Cale Corp. paid

Q85: How does the partial equity method differ

Q91: Pepe, Incorporated acquired 60% of Devin Company

Q102: On January 4, 2011, Mason Co. purchased

Q108: On January 1, 2011, Chester Inc. acquired